Did you receive a letter or notice? Select the letter or notice you received below for more information.

If the letter you received does not contain a title, how do you determine what type of letter it is?

- On the bottom left of the letter it will have a CDTFA-#### number for the letter type.

- Example: CDTFA-1210-DET REV. 2 (9-20)

Customs Pre-Notification Letter (CDTFA-400-USC)

Why did I receive this letter?

We received information from U.S. Customs and Border Protection (CBP) indicating that you imported items into California for storage, use, or other consumption in this state during the previous calendar year which may require you to pay use tax.

Generally, if sales tax would apply when you buy physical merchandise in California, use tax applies when you make a similar purchase without tax from a business located outside the state. For these purchases, you are required to pay the use tax separately.

Use tax is due on or before April 15 following the year in which the purchase was made.

What do I need to do?

To respond to this letter online and view the imported items, go to our Online Services webpage.

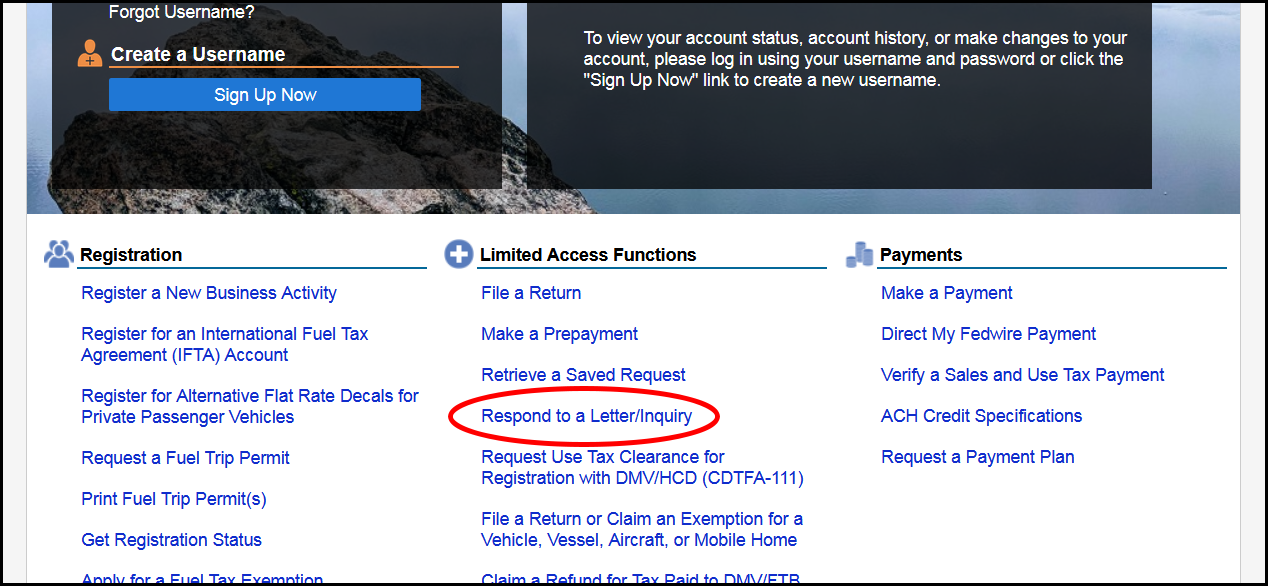

Click on the Respond to a Letter/Inquiry link under Limited Access Functions and enter the Letter ID and date listed at the top of the letter to proceed.

Additional Resources

Customs Statement of Proposed Liability (CDTFA-537)

Why did I receive this letter?

We received information from the U.S. Customs and Border Protection (CBP) indicating that you imported items into California for storage, use, or other consumption in this state during the previous calendar year. The amount listed on this letter is the tax due for the declared value of the imports for the identified year.

Generally, if sales tax would apply when you buy physical merchandise in California, use tax applies when you make a similar purchase without tax from a business located outside the state. For these purchases, you are required to pay the use tax separately. Use tax is due on or before April 15 following the year in which the purchase was made.

What do I need to do?

- Visit our Online Services webpage. Click the Respond to a Letter/Inquiry link under Limited Access Functions and use the Letter ID and date listed at the top of this letter to proceed. There you will be able to view the import information.

What if I disagree with the amount due?

If you believe use tax is not due, you will still need to file a return, claim an exemption, and upload copies of your supporting documentation. If a return or payment is not received within 15 days from the date of the letter, a Notice of Determination (billing) may be issued to you, as authorized by section 6481 of the Sales and Use Tax Law.

Additional Resources

Demand for Immediate Payment (CDTFA-1210-DEM)

Why did I receive this letter?

What do I need to do?

You must pay in full unless you are in a payment plan for the amounts listed. You can submit a payment online by logging in to your account with your username and password. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

If you are paying by check, please write your account number and Letter ID (listed on the top right of your letter) on the check and include the payment voucher provided with your letter in your envelope. Make your check payable to the California Department of Tax and Fee Administration and mail it to:

California Department of Tax and Fee AdministrationPO Box 942879

Sacramento CA 94279-7072

What if I am unable to make the payment?

You can request a payment plan online by logging in to your account with your username and password or by contacting your local office. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

Additional Resources

Excess Tax Reimbursement Letter (CDTFA-5033)

Why am I receiving this letter?

What do I need to do?

Review your return filed for the period listed on the letter and verify if the figures reported were correct.

- If the return is not correct, please submit an amended return.

- If the return is correct as filed, any excessive collection of tax, fee, or surcharge from your customers cannot be retained by you or your business. For the excess tax collected you can either:

- Refund the over-collected tax, fee, or surcharge to the specific customer(s) from whom it was over-collected. If you select this option, you should:

- Maintain detailed records of the refund for audit purposes.

- Provide a written explanation of how you are resolving the excess tax collection in response to the letter. Please send your letter to the address that can be found on the top left of the letter.

- Pay the amount stated on the letter. You can submit a payment online by logging in to your account with your username and password. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

If you are paying by check, please write your account number and Letter ID (listed on the top right of your letter) on the check. Make your check payable to the California Department of Tax and Fee Administration and mail it to:

California Department of Tax and Fee Administration

PO Box 942879

Sacramento CA 94279-7072

- Refund the over-collected tax, fee, or surcharge to the specific customer(s) from whom it was over-collected. If you select this option, you should:

What if I have further questions?

Notice of Cancellation of Permit/License/Account (CDTFA-1293-A)

Why did I receive this letter?

What do I need to do?

Contact your local office for assistance with reinstating your permit/license/account if you are operating and still are required to have a permit/license/account with us.

Note: If you are not operating your business and all returns and payments have been filed, no action is needed.

Notice of Delinquency (CDTFA-431-XXX)

Why did I receive this letter?

What do I need to do?

- File the return for the delinquent period(s). You must file the return even if you had zero sales for the period.

- Make a payment for any amount due.

For assistance logging in, filing a return, or making a payment please view our video tutorials for guidance on how to perform any of these tasks.

What if I am unable to make the payment?

What if I am no longer in business?

Notice of Delinquency (CDTFA-431-CUTS)

Why did I receive this letter?

What do I need to do?

You must file a return to pay the use tax or claim an exemption. To submit the return electronically, visit our Online Services webpage.

- Under Limited Access Functions, click the File a Return or Claim an Exemption for a Vehicle, Vessel, Aircraft, or Mobile Home link.

- Follow the prompts and upload supporting documentation for your transaction, such as your purchase invoice.

To submit the return via mail, please complete CDTFA-401-CUTS Combined State and Local Consumer Use Tax Return for Vehicle, Mobilehome, Vessel, or Aircraft and mail the return along with supporting documents to:

Consumer Use Tax Section MIC: 37

PO BOX 942879

Sacramento, CA 94279-8074

What if I have further questions?

Notice of Determination (CDTFA-1210-XX)

Why did I receive this letter?

What do I need to do?

- Pay the amount due shown on the letter.

Pay the amount due shown on the letter.

You can submit a payment online by logging in to your account with your username and password. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

If you are paying by check, please write your account number and Letter ID (listed on the top right of your letter) on the check and include the payment voucher provided in the letter in your envelope. Make your check payable to the California Department of Tax and Fee Administration and mail it to:

California Department of Tax and Fee AdministrationPO Box 942879

Sacramento CA 94279-7072

What if I disagree with the amount due?

What if I am unable to make the payment?

You can request a payment plan online by logging in to your account with your username and password or by contacting your local office. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

Additional Resources

Notice of Levy (CDTFA-425-LA)

Why did I receive this letter?

What do I need to do?

Contact the levying officer listed on the bottom of the first page of your letter to discuss your account.

Additional Resources

Notice of Pending Account Closure (CDTFA-1293)

Why did I receive this letter?

We are planning to close your permit, license, or account because you have not reported any recent sales or purchases, or you did not conduct qualifying business activities for your account listed on the letter.

What do I need to do?

If you have no sales during the period outlined in the letter and no longer need your permit, license, or account, no action is needed. If you had sales to report during the period, you should file or amend your return. If you need to retain your account, you will need to respond to this letter online by visiting our Online Services webpage.

Under the Limited Access Functions (located at the bottom) click Respond to a Letter/Inquiry (see image below). Enter the Letter ID and Letter Date and click Search. Once the system locates the letter, select Continue. Please provide your written response and select Submit.

Notice of Proposed Liability (CDTFA-846)

Why did I receive this letter?

We did not receive your filed return for the account number and period listed on your letter. Therefore, a liability was created to assess for the period for which you did not file.

What do I need to do?

- File the return for the period listed on the letter.

- Make a payment for any amount due.

What if I disagree with the amount due?

- File your return as soon as possible for the period on the letter.

For assistance logging in, filing a return, and/or making a payment please view our video tutorials.

What if I am unable to make the payment?

You can request a payment plan online by logging in to your account with your username and password or by contacting your local office. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

Additional Resources

Notice to Appear (CDTFA-431-XX)

Why did I receive this letter?

What do I need to do?

- File the return(s) for the delinquent period(s). You must file the return(s) even if you had zero sales for the period. If you no longer need your permit, you can close it out by logging in to your online services account. Under I Want To click More and select Account Closure in the Account Maintenance section.

- Make a payment for any amount due.

For assistance logging in, filing a return, or making a payment please view our video tutorials for guidance on how to perform any of these tasks.

What if I am unable to make the payment?

What if I am no longer in business?

Questionable Deductions Letter (CDTFA-1641)

Why am I receiving this letter?

One or more of the deductions claimed on your return(s) for the period(s) stated on the letter:

- Do not appear to match your registered business type

- Do not appear to be valid non-taxable transactions, or

- The amount(s) reported do not appear to reconcile with other figures reported on the return(s).

What do I need to do?

Review the deductions claimed on your return(s) filed for the period(s) listed on the letter and verify if the figures reported were correct.

- If you find the return is not correct, please submit an amended return.

- If the rest of the return was correct as filed and you agree that the deductions were incorrect, you may pay the amount stated on the letter. You can submit a payment online by logging in to your account with your username and password. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

If you are paying by check, please write your account number and Letter ID (listed on the top right of your letter) on the check. Make your check payable to the California Department of Tax and Fee Administration and mail it to:

California Department of Tax and Fee Administration

PO Box 942879

Sacramento CA 94279-7072 - If the return was correct as filed, please respond to the letter at the mailing address listed at the top of your letter with a detailed explanation describing the types of transactions included in the deduction(s) in question.

Additional Resources

Schedule A Letter (CDTFA-5030)

Why am I receiving this letter?

What do I need to do?

Review your return(s) filed for the period(s) listed on the letter and verify if the figures reported were correct and that your taxable transactions were allocated to the correct county and city on Schedule A-District Tax Allocation.

- If the original return was not correct, please submit an amended return.

- If the original figures were not correct and you agree with the suggested amount due included in the letter, you may submit a payment online by logging in to your account with your username and password. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions..

If you are paying by check, please write your account number and Letter ID (listed on the top right of your letter) on the check. Make your check payable to the California Department of Tax and Fee Administration and mail it to:

California Department of Tax and Fee AdministrationPO Box 942879

Sacramento CA 94279-7072

If the return was correct as filed, please respond to the letter with a written explanation to clarify the identified errors. Be sure to include your account number and Letter ID.

What if I have further questions?

Contact us at the telephone number located on the top left of the letter.

Additional Resources

Statement of Account (CDTFA-1210-STA)

Why did I receive this letter?

What do I need to do?

You must pay in full unless you are in a payment plan for the amounts listed or any of the amounts are under appeal or protection of the bankruptcy court. You can submit a payment online by logging in to your account with your username and password. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

If you are paying by check, please write your account number and Letter ID (listed on the top right of your letter) on the check and include the payment voucher provided with the letter in your envelope. Make your check payable to the California Department of Tax and Fee Administration and mail it to:

California Department of Tax and Fee AdministrationPO Box 942879

Sacramento CA 94279-7072

What if I am unable to make the payment?

You can submit a payment plan request online by logging in to your account with your username and password or by contacting your local office. If you do not have a username and password, you can register for them by clicking Sign Up Now and following the instructions.

Additional Resources

Statement of Proposed Liability (CDTFA-432)

Why did I receive this letter?

We have not received a response to previous issued letters we sent you regarding your purchase of a vehicle, vessel, aircraft, or mobile home. The letter is our estimated billing.

What do I need to do?

You must file a return to pay the use tax or claim an exemption. To submit the return electronically, visit our Online Services webpage.

- Under Limited Access Functions, click the File a Return or Claim an Exemption for a Vehicle, Vessel, Aircraft, or Mobile Home link.

- Follow the prompts and upload supporting documents, for your transaction, such as your purchase invoice.

To submit the return via mail, please complete CDTFA-401-CUTS Combined State and Local Consumer Use Tax Return for Vehicle, Mobilehome, Vessel, or Aircraft and mail the return along with supporting documents to:

Consumer Use Tax Section MIC: 37

PO BOX 942879

Sacramento, CA 94279-8074

What if I disagree with the amount due?

If you believe you do not owe use tax, you still need to file a return, claim an exemption, and upload copies of your supporting documents. If we do not receive your return or payment within 30 days, we will send you a bill, as authorized by section 6481 of the Sales and Use Tax Law. If you do not agree with the estimated billing amount, please provide documentation to support the actual purchase price such as a Bill of Sale or Purchase Agreement.

What if I have further questions?

Vehicle, Vessel, Aircraft, Mobile Home- Use Tax Not Paid Contact Letter (CDTFA-1169-B)

Why did I receive this letter?

We received information from the California Department of Motor Vehicles (DMV), the United States Coast Guard (USCG), or the Federal Aviation Administration (FAA) indicating that you purchased a vehicle, vessel, mobile home, or aircraft and you may be required to pay use tax.

What do I need to do?

You must file a return to pay the use tax or claim an exemption. To submit the return electronically, visit our Online Services webpage.

- Under Limited Access Functions, click the File a Return or Claim an Exemption for a Vehicle, Vessel, Aircraft, or Mobile Home link.

- Follow the prompts and upload supporting documentation for your transaction, such as your purchase invoice.

To submit the return via mail, please complete CDTFA-401-CUTS Combined State and Local Consumer Use Tax Return for Vehicle, Mobilehome, Vessel, or Aircraft and mail the return along with supporting documents to:

Consumer Use Tax Section MIC: 37

PO BOX 942879

Sacramento, CA 94279-8074

What if I have further questions?

Note: If you still have questions or your notice is not listed here, contact us at the telephone number listed on your notice or letter.