Laws, Regulations and Annotations

Lawguide Search

Business Taxes Law Guide—Revision 2025

Transactions and Use Tax Annotations

800.0000 Application of Transactions (Sales) Tax and Use Tax—Regulation 1823

Annotation 800.0040

800.0040 Purchases of Fleet Vehicles by State Agencies. State agencies may purchase a vehicle in one location, register it to a second location (generally Sacramento), and operate it from a third. If a fleet vehicle purchaser buys a vehicle from a dealer located in a district and takes delivery there, then that district's transactions tax applies. On the other hand, merely registering in a district a vehicle purchased outside that district does not subject the purchase to that district's use tax. Regulation 1827(b)(3) does not deal specifically with situations involving fleet vehicles where the county of registration is not always the same as the county in which the vehicle is used. Thus, the location where the vehicle is delivered, where it is used, and where it is registered all affect the application of district tax.

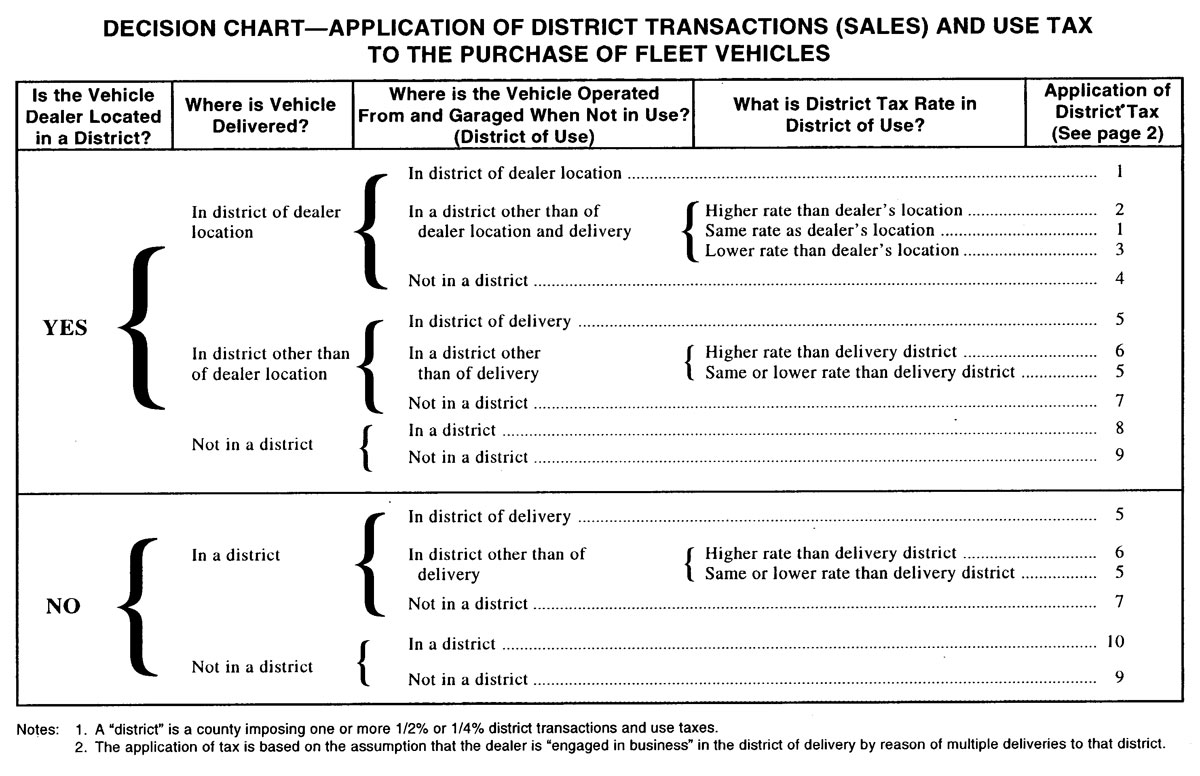

The following decision table was developed to illustrate at least ten different applications of district tax that may occur in the above situation depending on the precise circumstances of the sale:

Decision Chart—Application of District Transactions (Sales) and Use Tax to the Purchase of Fleet Vehicles

KEY APPLICATION OF TAX

(1) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located. The buyer has no reporting responsibilities.

(2) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located. Also, if the buyer registers the vehicle in the district of use that has a higher rate, the dealer is responsible for reporting the additional district use tax for district of use. If the buyer does not register the vehicle in the district of use, the buyer is directly responsible for reporting the additional district use tax for the district of use.

(3) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located, unless the buyer provides a declaration (copy attached) stating the vehicle will be used in the district with a lower rate, in which case the dealer is responsible for reporting the district use tax for the district of use. The buyer has no reporting responsibilities.

(4) Vehicle dealer is responsible for reporting the district sales tax for the district in which the dealer is located, unless the buyer provides a declaration (copy attached) stating the vehicle will not be used in any district, in which case the dealer is not responsible for reporting district tax. The buyer has no reporting responsibilities.

(5) Vehicle dealer is responsible for reporting the district use tax for the district of delivery. The buyer has no reporting responsibilities.

(6) Vehicle dealer is responsible for reporting the district use tax for the district in which the vehicle is delivered. Also, if the buyer registers the vehicle in the district of use that has a higher rate, the dealer is responsible for reporting the additional district use tax for the district of use. If the buyer does not register the vehicle in the district of use, the buyer is directly responsible for reporting the additional district use tax for the district of use.

(7) Vehicle dealer is responsible for reporting the district use tax for the district in which the vehicle is delivered. The buyer may submit a claim for refund for the total district use tax paid to the district of delivery.

(8) Vehicle dealer is not responsible for reporting district tax, unless buyer registers the vehicle in the district of use, in which case the dealer must report the district use tax for the district where the vehicle will be used. If the buyer does not register the vehicle in the district of use, the buyer is directly responsible for reporting the district use tax to the district where the vehicle will be used.

(9) Neither the buyer nor the seller have any district tax reporting responsibilities.

(10) The seller is not responsible for reporting the district use tax unless the vehicle is registered in the district where it will be used. If the vehicle is not registered in the district of use, the buyer is responsible for reporting district use tax to the district of use.

PLACE OF DELIVERY OF CERTAIN VEHICLES, AIRCRAFT AND UNDOCUMENTED VESSELS.

(2) For commercial vehicles:

DECLARATION (Commercial Vehicle)

I HEREBY CERTIFY THAT:

(1) The (here insert description of commercial vehicle, giving name of manufacturer and type) purchased from (insert name of seller) will be registered to the following address:

(2) The vehicle will be operated from the following address:

(3) The address from which the vehicle will be operated is outside the (name of district) District.

(4) When not in use, the vehicle will be kept or garaged at:

(5) The vehicle will be stored, used or otherwise consumed principally outside the (name of district) District.

(6) □ (a) The purchaser does not hold a California seller's permit.

□ (b) The purchaser holds California seller's permit No.

(Check applicable box.)

I understand that this declaration is for the purpose of allowing the above named seller to treat the sale of the above described tangible personal property as exempt from the transactions (sales) tax imposed by the (name of district) District. If the property is principally stored, used or otherwise consumed in that district, the purchaser shall be liable for and pay the use tax.

The foregoing declaration is made under penalty of perjury.

PURCHASER

TITLE

AUTHORIZED AGENT

DATE