Laws, Regulations and Annotations

Search

Business Taxes Law Guide—Revision 2025

Sales And Use Tax Regulations

Title 18. Public Revenues

Division 2. California Department of Tax and Fee Administration — Business Taxes (State Board of Equalization — Business Taxes — See Chapters 6 and 9.9)

Chapter 4. Sales and Use Tax

Article 6. Specific Businesses Engaged in Retailing

Regulation 1566.1

Regulation 1566.1. Auto Auctions and Auto Dismantlers.

Reference: Sections 6011, 6012, 6015, 6091, 6092, 6092.5, 6093, 6094.5, 6242, and 6243 Revenue and Taxation Code.

(a) Definitions.

(1) Qualified Person. A "qualified person" means a person making a sale at auction or a dismantler licensed under the Vehicle Code.

(2) Vehicle. "Vehicle" means:

(A) A mobilehome or commercial coach required to be registered annually under the Health and Safety Code.

(B) A vehicle required to be registered under the Vehicle Code or subject to identification under Division 16.5 (commencing with Section 38000) of the Vehicle Code.

(C) A vehicle that qualifies under the permanent trailer identification plate program pursuant to subdivision (a) of Section 5014.1 of the Vehicle Code.

(D) Any salvage certificate vehicle as defined in Section 11515 of the Vehicle Code.

(b) Presumption.

(1) It is presumed that a sale of a "vehicle" by a "qualified person" is a sale at retail and not a sale for resale.

(2) Rebutting the Presumption. To rebut the presumption, a "qualified person" may timely take in good faith a resale certificate in the form described in subdivision (c) from any of the following:

(A) A person that certifies it is licensed, registered, regulated, or certificated under the Health and Safety Code or the Vehicle Code as a dealer or dismantler.

(B) A person that certifies it is licensed, registered, regulated, or certificated under the Business and Professions Code as an automotive repair dealer, or is qualified as a scrap metal processor as described in the Vehicle Code.

(C) A person that certifies it is licensed, registered, regulated, certificated, or otherwise authorized by another state, country, or jurisdiction to do business as a dealer, dismantler, automotive repairer, or scrap metal processor.

(3) A "qualified person" shall not accept a resale certificate from any person except as provided in subdivision (b)(2).

(4) A certificate will be considered timely if it is taken at any time before the seller bills the purchaser for the property, or any time within the seller’s normal billing and payment cycle, or any time at or prior to delivery of the property to the purchaser. A resale certificate remains in effect until revoked in writing.

(5) In absence of evidence to the contrary, a seller will be presumed to have taken a resale certificate in good faith if the certificate contains the essential elements as described in subdivision (c)(1) and otherwise appears to be valid on its face.

(c) Form of Certificate.

(1) Any document, such as a letter or purchase order, timely provided by the purchaser to the seller will be regarded as a resale certificate with respect to the sale of the property described in the document if it contains all of the following essential elements:

(A) The signature of the purchaser, purchaser’s employee or authorized representative of the purchaser.

(B) The name and address of the purchaser.

(C) The number of the seller’s permit held by the purchaser. If the purchaser is not required to hold a permit because the purchaser makes no sales in this State, the purchaser must include on the certificate the reason the purchaser is not required to hold a California seller’s permit in lieu of a seller's permit number.

(D) A statement that the property described in the document is purchased for resale in the regular course of business. The document must contain the phrase "for resale." The use of phrases such as "non-taxable," "exempt," or similar terminology is not acceptable. The property to be purchased under the certificate must be described either by an itemized list of the particular property to be purchased for resale, or by a general description of the kind of property to be purchased for resale.

(E) A statement that the purchaser is licensed, registered, regulated, or certificated under the Health and Safety Code or the Vehicle Code as a dealer or dismantler; or is licensed, registered, regulated, or certificated under the Business and Professions Code as an automotive repair dealer; or is qualified as a scrap metal processor as described in the Vehicle Code; or is licensed, registered, regulated, certificated, or otherwise authorized by another state, country, or jurisdiction to do business as a dealer, dismantler, automotive repairer, or scrap metal processor. The purchaser shall include the license or registration number, as applicable. If the purchaser is regulated by another state, the certification should identify the state.

(F) Date of execution of document. (An otherwise valid resale certificate will not be considered invalid solely on the ground that it is undated.)

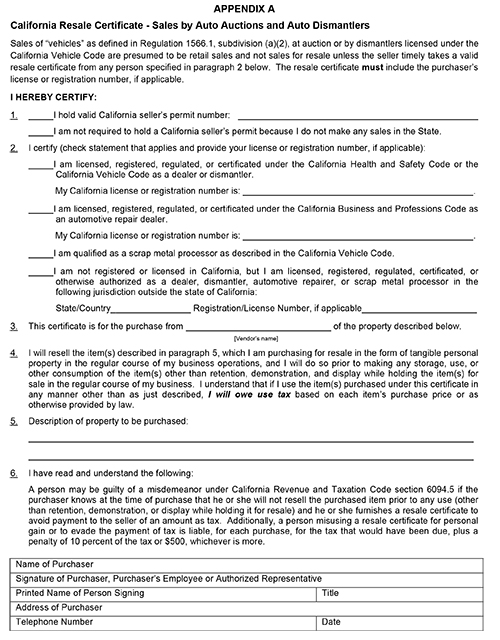

(2) A document containing the essential elements described in subdivision (c)(1) is the minimum form which will be regarded as a resale certificate. However, in order to preclude potential controversy, the seller should timely obtain from the purchaser a certificate substantially in the form shown in Appendix A of this regulation.

(d) Other Evidence to Rebut the Presumption that the Sale is at Retail. If the seller does not timely obtain a resale certificate in the form described in subdivision (c), the seller will be relieved of liability for the tax only where the seller shows through some alternative verifiable method that the property:

(1) Was in fact resold by the purchaser and was not stored, used, or otherwise consumed by the purchaser for any purpose other than retention, demonstration, or display while holding it for sale in the regular course of business, or

(2) Is being held for resale by the purchaser and has not been stored, used, or otherwise consumed by the purchaser for any purpose other than retention, demonstration, or display while holding it for sale in the regular course of business, or

(3) Was stored, used, or otherwise consumed by the purchaser and tax was reported directly to the Board by the purchaser on the purchaser's sales and use tax return, or

(4) Was stored, used, or otherwise consumed by the purchaser and tax was reported to the Department of Housing and Community Development, acting for and on behalf of the Board, at the time of making application for registration, or

(5) Was stored, used, or otherwise consumed by the purchaser and tax was reported to the Department of Motor Vehicles, acting for and on behalf of the Board, at the time of making application for registration or identification, or

(6) Was stored, used, or otherwise consumed by the purchaser and tax was paid to the Board by the purchaser pursuant to an assessment against or audit of the purchaser developed either on an actual basis or test basis.

(e) Purchaser’s Liability for Tax. A purchaser who issues a resale certificate containing the essential elements as described in subdivision (c) and that otherwise appears valid on its face, and who thereafter makes any storage, use, or other consumption of the property other than retention, demonstration, or display while holding it for sale in the regular course of business is liable for use tax on the cost of the property. The tax is due at the time the property is first stored, used, or otherwise consumed and must be reported and paid by the purchaser with the purchaser’s tax return for the period in which the property is first so stored, used, or otherwise consumed. A purchaser cannot retroactively rescind or revoke a resale certificate and thereby cause the transaction to be subject to sales tax rather than use tax.

A purchaser who issues a resale certificate for property which the purchaser knows at the time of purchase is not to be resold in the regular course of business is liable for the sales tax on that purchase measured by the gross receipts from the sale to that purchaser. The tax is due as of the time the property was sold to the purchaser and must be reported and paid by the purchaser with the purchaser's tax return for the period in which the property was sold to the purchaser.

History—Adopted August 13, 2013, effective January 1, 2014.