Laws, Regulations and Annotations

Search

Business Taxes Law Guide—Revision 2024

Sales And Use Tax Regulations

Title 18. Public Revenues

Division 2. California Department of Tax and Fee Administration — Business Taxes (State Board of Equalization — Business Taxes — See Chapters 6 and 9.9)

Chapter 4. Sales and Use Tax

Article 3. Manufacturers, Producers, Processors

- 1524 Manufacturers of Personal Property

- 1525 Property Used in Manufacturing

- 1525.1 Manufacturing Aids

- 1525.2 Manufacturing Equipment [Repealed.]

- 1525.3 Manufacturing Equipment—Leases of Tangible Personal Property [Repealed.]

- 1525.4 Manufacturing, Research and Development, and Electric Power Equipment

- 1525.5 Manufacturing By-Products and Joint-Products

- 1525.7 Rural Investment Tax Exemption [Repealed.]

- 1526 Producing, Fabricating and Processing Property Furnished by Consumers—General Rules

- 1527 Sound Recording

- 1528 Photographers, Photocopiers, Photo Finishers and X-Ray Laboratories

- 1529 Motion Pictures

- 1530 Foundries

- 1531 Fur Dressers and Dyers

- 1532 Teleproduction or Other Postproduction Service Equipment

- 1533 Liquefied Petroleum Gas

- 1533.1 Farm Equipment and Machinery

- 1533.2 Diesel Fuel Used in Farming Activities or Food Processing

- 1534 Timber Harvesting Equipment and Machinery

- 1535 Racehorse Breeding Stock

Regulation 1524. Manufacturers of Personal Property.

Reference: Sections 6011, 6012, and 6018.6, Revenue and Taxation Code.

Bad Debts, see Regulation 1642.

Tax Paid Purchases Resold, see Regulation 1701.

(a) In General. Tax applies to the gross receipts from retail sales (i.e., sales to consumers) by manufacturers, producers, processors, and fabricators of tangible personal property the sale of which is not otherwise exempted. The measure of the tax is the gross receipts of, or sales price charged by, the manufacturer, producer, processor, or fabricator, from which no deduction may be taken on account of the cost of the raw materials or other components purchased, or labor or service costs to create or produce the tangible personal property, or of any step in the manufacturing, producing, processing, or fabricating, including work performed to fit the customer's specific requirements, whether or not performed at the customer's specific request, or any other services that are a part of the sale. In addition, no deduction may be taken on account of interest paid, losses, or any other expense.

(b) Particular Applications.

(1)Alterations of New and Used Items.

(A) Alteration of New Items means and includes any work performed upon new items such as garments, bedding, draperies, or other personal and household items to meet the requirements of the customer, whether the work involves the addition of material to the item, the removal of material from the item, the rearranging or restyling of the item, or otherwise altering the item, when such alterations result in the creation or production of a new item or constitute a step in the creation or production of a new item for the customer.

Charges for the alteration of new items are subject to tax, except as provided in subdivision (c)(4) of Regulation 1506, regardless of whether the charges for the alterations are separately stated or included in the price of the item, or whether the alterations are performed by the seller of the item or by another person. Persons engaged in the producing, processing or fabricating of new items are retailers, not consumers, of the alterations provided to the customer and are required to hold a seller's permit.

(B) Alteration of Used Items means and includes the mending, shortening or lengthening, taking in or letting out, or otherwise altering used items such as garments, bedding, draperies, or other personal and household items when such alterations merely refit or repair the item for the use for which it was created or produced.

Charges for the alteration of used items are not subject to tax. Generally, persons performing the alteration of used items are consumers, not retailers, of the supplies and materials furnished in connection with the alterations, and tax applies to the sale of the supplies and materials to such persons.

Except as provided in subdivision (c)(4) of Regulation 1506, persons performing the alteration of used items are retailers, not consumers, of the supplies and materials furnished in connection with the alterations when the retail value of the supplies and materials is more than 10 percent of the total charge for the alterations, or if the invoice to the customer includes a separate charge for such property. When such persons are retailers, not consumers, tax applies to the fair retail selling price of the supplies and materials to the customer.

When the retail value of the supplies and materials is more than 10 percent of the total charge to the customer, the person performing the alterations must segregate on the invoice to the customer and in its records, the fair retail selling price of the supplies and materials from the charge for the alterations. "Total charge" means the combined total of the retail value of the supplies and materials furnished or consumed as part of the alterations and the labor charges for the alterations.

(2) Painting, Polishing, Finishing. Tax applies to charges for painting, polishing, and otherwise finishing tangible personal property in connection with the production of a finished product for consumers, whether the article to be finished is supplied by the customer or by the finisher. Tax does not apply to charges for painting or finishing real property.

History—Effective July 1, 1939.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended and renumbered August 4, 1970, effective September 5, 1970.

Amended April 8, 1987, effective August 8, 1987. In subdivision (b)(1)(2), added reference to application of tax to persons who operate clothes cleaning or clothes dyeing establishments.

Amended December 17, 2008, effective April 10, 2009. Amended subdivision (a) to include producers, processors, and fabricators of tangible personal property with manufacturers. Amended subdivision (b)(1) to clarify how tax applies to charges for alterations of new or used items. Deleted subdivision (b)(2) and renumbered former subdivision (b)(3) accordingly.

Regulation 1525. Property Used in Manufacturing.

Reference: Sections 6007–6009.1, Revenue and Taxation Code.

(a) Tax applies to the sale of tangible personal property to persons who purchase it for the purpose of use in manufacturing, producing or processing tangible personal property and not for the purpose of physically incorporating it into the manufactured article to be sold. Examples of such property are machinery, tools, furniture, office equipment, and chemicals used as catalysts or otherwise to produce a chemical or physical reaction such as the production of heat or the removal of impurities.

(b) Tax does not apply to sales of tangible personal property to persons who purchase it for the purpose of incorporating it into the manufactured article to be sold, as, for example, any raw material becoming an ingredient or component part of the manufactured article.

(c) Particular Application of New Oak Wine Barrels. Tax does not apply to sales of new, used, or re-coopered oak barrels to persons who purchase the barrels for the purpose of physically incorporating oak into wine to be sold. Re-coopered barrels have the inner surface shaved off to expose new wood. The use of oak wine barrels as a container during the manufacturing process is incidental to the primary purpose of incorporating oak into the wine.

(d) Particular Application of Brandy Barrels. Tax does not apply to sales of new or used oak barrels to persons who purchase the barrels for the purpose of physically incorporating oak into brandy to be sold. The use of the barrels as containers during the manufacturing process is incidental to the primary purpose of incorporating oak into the brandy.

History—Effective August 1, 1933.

Adopted as of January 1, 1945, as a restatement of previous rulings.

Amended by renumbering November 3, 1971, effective December 3, 1971.

Amended January 10, 1996, effective April 3, 1996. Added subdivision (c).

Amended October 8, 1997, effective April 4, 1998. Subdivision (d) added.

Amended January 6, 1999, effective May 1, 1999. Subdivision (c) is amended as follows: phrase ", used, or re-coopered" added to first sentence; new second sentence added; word "new" deleted from former second, now the third, sentence.

Sales Tax General Bulletin 50–24; July 10, 1950.

Subject: Regulation 1525, Property Used in Manufacturing, and Regulation 1541, Printing and Related Arts, as Applied to Dies, Patterns, Jigs, Tooling, Photo Engravings, and Other Manufacturing Aids.

When manufacturers purchase, or fabricate from raw materials purchased, dies, patterns, jigs, tooling, photo engravings, and other manufacturing or printing aids for the account of customers who acquire title to the property upon delivery thereof to, or upon the completion of the fabrication thereof by, the manufacturers, the manufacturers will be regarded as purchasing such property either as agent for, or for resale to, their customers. The tax will apply, accordingly, with respect either to the sale to the manufacturer as agent of his customer, or with respect to the sale by the manufacturer to the customer, and not also with respect to the sale to the manufacturer.

In determining whether the manufacturer or printer purchases the property on behalf of, or for resale to, his customer, the terms of the contract with the customer, the custom or usage of the trade and any other pertinent factors will be considered. For example, if the customer issues a purchase order for a pattern, die, or other tool, or on the purchase order for the goods itemizes or otherwise specifies the particular pattern, die, or tool which will be required by the manufacturer or printer to manufacture the goods desired by the customer, and the manufacturer obtains such tool pursuant to the customer's specific order, billing, itemizing, or otherwise identifying it to the customer separately from the billing for the article manufactured therefrom, and either delivers it to the customer or holds it as bailee for the customer, it will be presumed that the manufacturer acquired the property on behalf of the customer or for immediate resale to him.

Regulation 1525.1. Manufacturing Aids.

Reference: Sections 6007-6009.1 and 6010.5, Revenue and Taxation Code.

Tax applies to the sale of manufacturing aids such as dies, patterns, jigs and tooling used in the manufacturing process notwithstanding the fact that the property used in manufacturing may subsequently be delivered to or held as property of the person to whom the manufactured product is sold. If the contract of sale between the manufacturer and the customer provides that title to the manufacturing aid passes to the purchaser prior to physical use of the property in the manufacturing process, then the manufacturing aid or its raw materials, if the manufacturing aid is fabricated by the manufacturer, may be purchased for resale. Tax then applies, unless otherwise exempt, to the sale of the manufacturing aid by the manufacturer to the customer, and not also with respect to the sale to the manufacturer. If the contract provides that title to the manufacturing aid passes to the customer in this state prior to use, then a retail sale subject to tax occurs in this state even though the manufacturing aid may subsequently be shipped to a point outside this state.

History—Adopted August 20, 1985, effective November 22, 1985. Added this new regulation to explain the application of the sales and use tax to the sale of manufacturing aids such as dies, patterns, jigs, and tooling used in manufacturing other items of tangible personal property.

Business Taxes General Bulletin 61–2; January 16, 1961,

Revised June 9, 1967 and June 15, 1967.

Subject: Regulation 1525, Property Used in Manufacturing, and Regulation 1668, Resale Certificates, as Applied to Salt Used in Food Processing.

(a) Application of Tax.

(1) Section 6359 of the Sales and Use Tax Law exempts sales of "food products for human consumption", and provides that the term "food products" includes… "salt"…

Accordingly, the sale of salt for human consumption as such, or as a component part of other foods for human consumption, such as pickles and olives, is exempt from the tax.

(2) Sales of salt to manufacturers or processors of food products or other commodities are not exempt as sales for resale if the salt is purchased for any purpose other than resale as a component part of the manufactured article. Section 6007 defines a "retail sale" as "a sale for any purpose other than resale in the regular course of business in the form of tangible personal property". Thus, if salt is purchased by a manufacturer for use in the manufacturing process (other than incorporation into the manufactured product), the sale of the salt is not exempt, either as a food product for human consumption or as a sale for resale.

(A) Examples of use in the manufacturing process are:

1. As a brine for storing, curing, or pickling when the food product is withdrawn from the brine prior to sale, except that portion of the salt purchased which remains in the food product to be sold.

2. Cleaning and grading food products by means of a flotation process.

3. Water softening.

(B) Examples of incorporation into the manufactured product are:

1. The placing of salt in the containers in which food products are placed and sold.

2. The placing of salt in a brine to be placed in containers in which food products are placed and sold.

3. The placing in a brine of all of the salt intended to remain in the food product to be sold, notwithstanding the fact that a portion of the brine must be discarded because of impurities forming in the brine before all of the salt can be incorporated in the food product to be sold.

(b) Resale Certificates.

(1) The law governing the use of resale certificates is set out in several sections of the Sales and Use Tax Law as follows:

"6091. For the purpose of the proper administration of this part and to prevent evasion of the sales tax it shall be presumed that all gross receipts are subject to the tax until the contrary is established. The burden of proving that a sale of tangible personal property is not a sale at retail is upon the person who makes the sale unless he takes from the purchaser a certificate to the effect that the property is purchased for resale.

"6092. Effect of certificate. The certificate relieves the seller from liability for sales tax only if taken in good faith from a person who is engaged in the business of selling tangible personal property and who holds the permit provided for in Article 2 (commencing with Section 6066) of this chapter.

"6094. Liability of purchaser. If a purchaser who gives a certificate makes any use of the property other than retention, demonstration, or display while holding it for sale in the regular course of business, the use shall be taxable to the purchaser under Chapter 3 (commencing with Section 6201) of this part as of the time the property is first used by him, and the sales price of the property to him shall be the measure of the tax.

"6094.5. Any person who gives a resale certificate for property which he knows at the time of purchase is not to be resold by him in the regular course of business for the purpose of evading payment to the seller of the amount of the tax applicable to the transaction is guilty of a misdemeanor."

(2) Resale certificates given by food processors and accepted by salt vendors must meet the requirements set forth in Regulation 1668. This is further explained by Form BT-741-A regarding "Resale Certificates—Their Use and Misuse" directed by the Secretary of the Board to all persons holding sellers' permits as of March 31, 1960. Inasmuch as a portion of the salt purchased by food processors is consumed and a portion is resold (see (a) (2) (A) and (a) (2) (B) above), the processors should determine by the best means possible the approximate percentage of all salt purchased that is resold and give resale certificates covering such percentage only. The percentage may vary with the type of salt sold, the type of food being processed, the processing methods used, and other factors. Studies have been made which indicate that when undried salt is sold to food processors who use the salt to make brine in which olives or pickles are processed, about 50% of the salt is resold with the olives or pickles and the remaining 50% is consumed by the food processors. Accordingly, it is in order for vendors of undried salt to accept resale certificates for 50% of each sale of undried salt to food processors who certify that the salt is to be used in making brine for processing olives or pickles for resale. Fifty percent of each such sale will be regarded as a taxable retail sale.

(3) Where a food processor is not a "seller" as defined by Section 6014 of the Sales and Use Tax Law and therefore is not required to hold a seller's permit, the food processor may nonetheless give a resale certificate in the same fashion as though he were a "seller". A statement substantially as follows may be entered on the resale certificate in lieu of a seller's permit number:

"Food processor selling only food products for human consumption."

(4) Inasmuch as the actual use of the salt purchased is within the specific knowledge of the manufacturer or processors rather than of the salt seller, purchasers holding sellers' permits may desire to follow the procedure authorized by Section 6012 of the Sales and Use Tax Law and Regulation 1701. Under this procedure, the purchasers of the salt would reimburse the salt vendors for tax on the total price of the salt. The purchasers would then deduct on their own tax returns the purchase price of the salt which is resold rather than used for some other purpose, a matter peculiarly within their knowledge rather than their vendors'. This procedure would give the purchasers an automatic credit for tax paid on purchases for resale, subject to audit of the purchasers, and the salt vendors would be relieved of any further responsibility.

Regulation 1525.2. Manufacturing Equipment.

[Repealed January 1, 2004, effective June 5, 2014.]

Regulation 1525.3. Manufacturing Equipment—Leases of Tangible Personal Property.

[Repealed January 1, 2004, effective June 5, 2014.]

Regulation 1525.4. Manufacturing, Research and Development, and Electric Power Equipment.

Reference: Section 6377.1, Revenue and Taxation Code.

(a) Partial Exemption for Property Purchased for Use in Manufacturing, Research and Development, and Electric Power Generation or Production, Storage, or Distribution. Except as provided in subdivision (d), beginning July 1, 2014, and before July 1, 2030, Revenue and Taxation Code (RTC) section 6377.1 provides a partial exemption from sales and use tax for certain sales and purchases, including leases, of tangible personal property as described in this regulation.

For the period beginning July 1, 2014, and ending on December 31, 2016, the partial exemption applies to the taxes imposed by RTC sections 6051 (except the taxes deposited pursuant to section 6051.15), 6051.3, 6201 (except the taxes deposited pursuant to section 6201.15), and 6201.3 and section 36 of article XIII of the California Constitution (4.1875%). The partial exemption does not apply to the taxes imposed or deposited pursuant to RTC sections 6051.2, 6051.5, 6051.15, 6201.2, 6201.5, or 6201.15, the Bradley-Burns Uniform Local Sales and Use Tax Law, the Transactions and Use Tax Law, or section 35 of Article XIII of the California Constitution.

For the period beginning January 1, 2017, and ending on June 30, 2030, the partial exemption applies to the taxes imposed by RTC sections 6051 (except the taxes deposited pursuant to section 6051.15), 6051.3, 6201 (except the taxes deposited pursuant to section 6201.15), and 6201.3 (3.9375%). The partial exemption does not apply to the taxes imposed or deposited pursuant to RTC sections 6051.2, 6051.5, 6051.15, 6201.2, 6201.5, or 6201.15, the Bradley-Burns Uniform Local Sales and Use Tax Law, the Transactions and Use Tax Law, or section 35 of article XIII of the California Constitution.

Subject to the limitation set forth above, this partial exemption from tax applies to the sale of and the storage, use, or other consumption in this state, of the following items:

(1) Qualified tangible personal property purchased for use by a qualified person to be used primarily in any stage of the manufacturing, processing, refining, fabricating, or recycling of tangible personal property, beginning at the point any raw materials are received by the qualified person and introduced into the process and ending at the point at which the manufacturing, processing, refining, fabricating, or recycling has altered tangible personal property to its completed form, including packaging, if required.

(2) Qualified tangible personal property purchased for use by a qualified person to be used primarily in research and development.

(3) Qualified tangible personal property purchased for use by a qualified person to be used primarily to maintain, repair, measure, or test any qualified tangible personal property described in subdivision (a)(1) or (2).

(4) Qualified tangible personal property purchased for use by a qualified person to be used primarily in the generation or production, storage, or distribution of electric power.

(5) Qualified tangible personal property purchased for use by a contractor purchasing that property for use in the performance of a construction contract for a qualified person, provided that the qualified person will use the resulting improvement on or to real property as an integral part of the manufacturing, processing, refining, fabricating, or recycling process, the generation or production, storage, or distribution of electric power, or as a research or storage facility for use in connection with those processes.

(b) Definitions. For the purposes of this regulation:

(1) "Distribution" means carrying electric power, regardless of the source of the electric power, to consumers at a voltage level that can be delivered directly to consumers. Distribution does not include the transmission of electric power. It is rebuttably presumed that qualified tangible personal property is used for distribution if the property is listed as a distribution asset in the qualified person's accounting or other records.

(2) "Fabricating" means to make, build, create, produce, or assemble components or tangible personal property to work in a new or different manner.

(3) "Generation or production" means the activity of making, producing, creating, or converting electric power from sources other than a conventional power source, as defined in Public Utilities Code section 2805. "Generation" and "production" do not include the activity of making, producing, creating, or converting electric power derived from nuclear energy or the operation of a hydropower facility greater than 30 megawatts or the combustion of fossil fuels, unless cogeneration technology, as defined in Public Resources Code section 25134, is employed in the production of such power.

(4) "Manufacturing" means the activity of converting or conditioning tangible personal property by changing the form, composition, quality, or character of the property for ultimate sale at retail or use in the manufacturing of a product to be ultimately sold at retail. Manufacturing includes any improvements to tangible personal property that result in a greater service life or greater functionality than that of the original property. Tangible personal property shall be treated as having a greater service life if such property can be used for a longer period than such property could have been used prior to the conversion or conditioning of such property. Tangible personal property shall be treated as having greater functionality if it has been improved in such a manner that it is more efficient or can be used to perform new or different functions.

(5) "Packaging" means to wrap, seal, box, or put together as a unit, but includes only that packaging necessary to prepare the goods for delivery to and placement in the qualified person's finished goods inventory, or to prepare goods so that they are suitable for delivery to and placement in finished goods inventory, including repackaging of such goods when repackaging is required to meet the needs of a specific customer. Packaging necessary to consolidate the goods prior to shipping or to protect them during transportation to the customer shall not be considered "packaging" for purposes of this regulation.

(6) "Pollution control" means any activity that results in the abatement, reduction, or control of water, land, or atmospheric pollution or contamination by removing, altering, disposing, storing, or preventing the creation or emission of pollutants, contaminants, wastes, or heat, but only to the extent that such activity meets or exceeds standards established by this state or by any local or regional governmental agency within this state at the time the qualified tangible personal property is purchased.

(7) "Primarily" means 50 percent or more of the time.

(8) "Process" means the period beginning at the point at which any raw materials are received by the qualified person and introduced into the manufacturing, processing, refining, fabricating, or recycling activity of the qualified person and ending at the point at which the manufacturing, processing, refining, fabricating, or recycling activity of the qualified person has altered tangible personal property to its completed form, including packaging as defined in subdivision (b)(5), if required. "Process" includes testing products for quality assurance which occurs prior to the tangible personal property being altered to its completed form, including packaging as defined in subdivision (b)(5), if required. Raw materials shall be considered to have been introduced into the process when the raw materials are stored on the same premises where the qualified person's manufacturing, processing, refining, fabricating, or recycling activity is conducted. Raw materials that are stored on premises other than where the qualified person's manufacturing, processing, refining, fabricating, or recycling activity is conducted shall not be considered to have been introduced into the manufacturing, processing, refining, fabricating, or recycling process.

(9) "Processing" means the physical application of the materials and labor necessary to modify or change the characteristics of tangible personal property.

(10)(A) "Qualified person" means a person that is primarily engaged in a qualifying line or qualifying lines of business, as provided in this subdivision.

1. Prior to January 1, 2018, qualifying lines of business are those lines of business described in Codes 3111 to 3399, inclusive, 541711, or 541712 of the North American Industry Classification System (NAICS) published by the United States Office of Management and Budget (OMB), 2012 edition.

On and after January 1, 2018, qualifying lines of business are those lines of business described in Codes 3111 to 3399, inclusive, 221111 to 221118, inclusive, 221122, 541711, or 541712 of the North American Industry Classification System (NAICS) published by the United States Office of Management and Budget (OMB), 2012 edition.

With respect to Codes 3111 to 3399, a person will not be precluded from the definition of a "qualified person" when there is no applicable six-digit NAICS code to describe their line of business, provided that their business activities are reasonably described in a qualified four-digit industry group. For example, a business in the recycling industry may be regarded as a qualified person when the activities of the establishment are reasonably described in a qualified four-digit industry group.

2. For purposes of this subdivision, a qualified person may be "primarily engaged" either as a legal entity or as an establishment within a legal entity. "Legal entity" means "person" as defined in RTC section 6005.

A person is "primarily engaged" as a legal entity if, in the prior financial year, the legal entity derived 50 percent or more of its gross revenue (including inter-company charges) from, or expended 50 percent or more of its operating expenses in a qualifying line of business. For example, a legal entity is a qualified person primarily engaged in a qualifying line of business if the legal entity's gross revenue from manufacturing constituted 50 percent or more of its total revenue. Revenue from research and development activities includes, but is not limited to, revenue derived from selling research and development services or licensing intellectual property resulting from research and development activities.

A person is "primarily engaged" as an establishment if, in the prior financial year, the establishment derived 50 percent or more of its gross revenue (including inter-company and intra-company charges) from, or expended 50 percent or more of its operating expenses in, a qualifying line of business. Alternatively, an establishment is "primarily engaged" if, in the prior financial year, it allocated, assigned or derived 50 percent or more of any one of the following to or from a qualifying line of business: (1) employee salaries and wages, (2) value of production, or (3) number of employees based on a full-time equivalency.

For purposes of these tests, gross revenue may be derived from a combination of activities in qualifying lines of business. For example, if a company derived 40 percent of its gross revenue from qualified manufacturing activities and 40 percent from non-qualified manufacturing activities; but, the remaining 20 percent of its gross revenue was derived from qualified research and development activities, the company would qualify because overall, 60 percent of its gross revenue was derived from activities in qualifying lines of business.

Similarly, the tests for operating expenses from qualifying lines of business cited in the qualifying NAICS codes would be considered in combination.

There may be more than one qualifying establishment within a legal entity.

In the case of a nonprofit organization or government entity, "primarily engaged" with regard to gross revenue means 50 percent or more of the funds allocated to the entity or establishment are attributable to a qualifying line or qualifying lines of business.

In cases where the purchaser was not primarily engaged in a qualifying line of business for the financial year preceding the purchase of the property, the one year period following the date of purchase of the property will be used.

3. For purposes of this subdivision, "establishment" includes multiple or single physical locations, including any portion or portions thereof, and those locations or combinations of locations, including any portion or portions thereof, designated as a "cost center" or "economic unit" by the taxpayer, where a qualified activity is performed, and for which the taxpayer maintains separate books and records that reflect revenue, costs, number of employees, wages or salaries, property and equipment, job costing, or other financial data pertaining to the qualified activity. A physical location may be described in more than one NAICS code.

4. An entity or establishment primarily engaged in manufacturing activities may purchase qualified tangible personal property subject to the partial sales and use tax exemption for use in research and development or generating or producing, storing, or distributing electric power, provided all other requirements for the exemption are met. An entity or establishment primarily engaged in research and development may purchase qualified tangible personal property subject to the partial sales and use tax exemption for use in manufacturing or generating or producing, storing, or distributing electric power, provided all other requirements for the exemption are met. An entity or establishment primarily engaged in generating or producing, storing, or distributing electric power may purchase qualified tangible personal property subject to the partial sales and use tax exemption for use in manufacturing or in research and development, provided all other requirements for the exemption are met. Where a person is primarily engaged as a legal entity, that person shall be considered a "qualified person" for purposes of this regulation for all purchases made by the legal entity, provided all other requirements of the exemption are met. Where a person conducts business at more than one establishment then that person shall be considered to be a "qualified person" for purposes of this regulation only as to those purchases that are intended to be used and are actually used in an establishment in which the purchaser is primarily engaged in a qualifying line or qualifying lines of business.

(B) Notwithstanding subdivision (b)(10)(A), "qualified person" does not include:

1. Prior to January 1, 2018, an apportioning trade or business that is required to apportion its business income pursuant to subdivision (b) of RTC section 25128 or a trade or business conducted wholly within this state that would be required to apportion its business income pursuant to subdivision (b) of RTC section 25128 if it were subject to apportionment pursuant to RTC section 25101.

In general, these apportioning trades or businesses derive more than 50 percent of their gross business receipts from an agricultural business activity, an extractive business activity, a savings and loan activity, or a banking or financial business activity as defined in subdivision (d) of RTC section 25128.

2. On or after January 1, 2018, an apportioning trade or business that is required to apportion its business income pursuant to subdivision (b) of RTC section 25128, or a trade or business conducted wholly within this state that would be required to apportion its business income pursuant to subdivision (b) of RTC section 25128 if it were subject to apportionment pursuant to RTC section 25101, other than an agricultural trade or business described in paragraph (1) of subdivision (c) of RTC section 25128.

(11)(A) "Qualified tangible personal property" includes, but is not limited to, the following:

1. Machinery and equipment, including component parts and contrivances such as belts, shafts, moving parts, and operating structures. For purposes of this subdivision, manufacturing aids as described in Regulation 1525.1, Manufacturing Aids, may be considered machinery and equipment, when purchased by a qualified person for use by that person in a manner qualifying for exemption, even though such property may subsequently be delivered to or held as property of the person to whom the manufactured product is sold. The manufacturing aids must have a useful life of one or more years.

2. Equipment or devices used or required to operate, control, regulate, or maintain the machinery, including, but not limited to, computers, data-processing equipment, and computer software, together with all repair and replacement parts with a useful life of one or more years therefor, whether purchased separately or in conjunction with a complete machine and regardless of whether the machine or component parts are assembled by the qualified person or another party.

3. Tangible personal property used in pollution control that meets or exceeds standards established by this state or any local or regional governmental agency within this state at the time the qualified tangible personal property is purchased.

4. Special purpose buildings and foundations used as an integral part of the manufacturing, processing, refining, fabricating, or recycling process, or that constitute a research or storage facility used during those processes. On or after January 1, 2018, this includes special purpose buildings and foundations used as an integral part of the generation or production, storage, or distribution of electric power. Buildings used solely for warehousing purposes after completion of those processes are not included. For purposes of this subdivision:

a. "Special purpose building and foundation" means only a building and the foundation underlying the building that is specifically designed and constructed or reconstructed for the installation, operation, and use of specific machinery and equipment with a special purpose and the construction or reconstruction of which is specifically designed and used exclusively for the specified purposes as set forth in subdivision (a) (the qualified purpose). Special purpose buildings and foundations also include foundations for open air structures that may not have ceilings or enclosed walls but are used exclusively for the specified purposes as set forth in subdivision (a).

b. A building or foundation is specifically designed and constructed or modified for a qualified purpose if it is not economic to design and construct the building or foundation for the intended purpose and then use the structure for a different purpose.

c. A building or foundation is used exclusively for a qualified purpose only if its use does not include a use for which it was not specifically designed and constructed or modified. Incidental use of a building or foundation for nonqualified purposes does not preclude the structure from being a special purpose building and foundation. "Incidental use" means a use which is both related and subordinate to the qualified purpose. A use is not subordinate if more than one-third of the total usable volume of the building is devoted to that use.

d. If an entire building and/or foundation does not qualify as a special purpose building and foundation, a qualified person may establish that a portion of the structure qualifies for treatment as a special purpose building and foundation if the portion satisfies all of the definitional provisions in this subdivision.

e. Buildings and foundations that do not meet the definition of a special purpose building and foundation set forth above include, but are not limited to, buildings designed and constructed or reconstructed principally to function as a general purpose industrial or commercial building or storage facilities that are used primarily before the point raw materials are introduced into the process and/or after the point at which the manufacturing, processing, refining, fabricating, or recycling has altered tangible personal property to its completed form.

f. The term "integral part" means that the special purpose building or foundation is used directly in the activity qualifying for the partial exemption from sales and use tax and is essential to the completeness of that activity. In determining whether property is used as an integral part of manufacturing, all properties used by the qualified person in processing the raw materials into the final product are properties used as an integral part of manufacturing.

(B) "Qualified tangible personal property" does not include any of the following:

1. Consumables with a useful life of less than one year.

2. Furniture, inventory, and equipment used in the extraction process, or equipment used to store finished products that have completed the manufacturing, processing, refining, fabricating, or recycling process. The extraction process includes such severance activities as mining and oil and gas extraction.

3. Tangible personal property used primarily in administration, general management, or marketing.

(12) "Recycling" means the process of modifying, changing, or altering the physical properties of manufacturing, processing, refining, fabricating, secondary or postconsumer waste which results in the reduction, avoidance or elimination of the generation of waste, but does not include transportation, baling, compressing, or any other activity that does not otherwise change the physical properties of any such waste.

(13) "Refining" means the process of converting a natural resource to an intermediate or finished product, but does not include any transportation, storage, conveyance or piping of the natural resources prior to commencement of the refining process, or any other activities which are not part of the process of converting the natural resource into the intermediate or finished product.

(14) "Research and development" means those activities that are described in Section 174 of the Internal Revenue Code or in any regulations thereunder. Research and development shall include activities intended to discover information that would eliminate uncertainty concerning the development or improvement of a product. For this purpose, uncertainty exists if the information available to the qualified person does not establish the capability or method for developing or improving the product or the appropriate design of the product.

(15) "Storage" means storing electric power regardless of the source of the electric power.

(16) "Transmission" means carrying electric power at a voltage level that cannot be delivered directly to consumers. Transmission begins immediately after electric power is stepped up to a voltage level that cannot be delivered directly to consumers and ends immediately before electric power is stepped down to a voltage level that can be delivered to consumers. It is rebuttably presumed that qualified tangible personal property is used for transmission if the property is listed as a transmission asset in the qualified person's accounting or other records.

(17) "Useful life." Tangible personal property that the qualified person treats as having a useful life of one or more years for state income or franchise tax purposes shall be deemed to have a useful life of one or more years for purposes of this regulation. Tangible personal property that the qualified person treats as having a useful life of less than one year for state income or franchise tax purposes shall be deemed to have a useful life of less than one year for purposes of this regulation. For the purposes of this subdivision, tangible personal property that is deducted under RTC sections 17201 and 17255 or RTC section 24356 shall be deemed to have a useful life of one or more years.

(c) Partial Exemption Certificate.

(1) In General. Qualified persons that purchase or lease qualified tangible personal property from an in-state retailer, or an out-of-state retailer obligated to collect use tax, must provide the retailer with a partial exemption certificate in order for the retailer to claim the partial exemption. If the retailer takes a timely partial exemption certificate in the proper form as set forth in subdivision (c)(3) and in good faith, from a qualified person, the partial exemption certificate relieves the retailer from the liability for the sales tax subject to exemption under this regulation or the duty of collecting the use tax subject to exemption under this regulation. A certificate will be considered timely if it is taken any time before the seller bills the purchaser for the property, any time within the seller's normal billing or payment cycle, or any time at or prior to delivery of the property to the purchaser.

On occasion, a purchaser may not know at the time of a purchase whether they will meet the requirements for the purpose of claiming the partial exemption. In such circumstances, the purchaser may issue a partial exemption certificate at the time of the purchase based on the purchaser's expectation that the purchaser will meet the requirements of the regulation. If those requirements are not met, the purchaser will be liable for payment of sales tax, with applicable interest, and the cost of the tangible personal property to the purchaser shall be deemed the gross receipts from that retail sale.

If the purchaser reimbursed the retailer for the full amount of sales tax at the time of purchase and later becomes aware that the requirements of this regulation are met, they may issue a partial exemption certificate to the retailer. If a retailer receives a certificate under these circumstances, the retailer may file a claim for refund for the excess sales tax reimbursement collected from the purchaser, as provided in subdivision (h).

The exemption certificate form set forth in Appendix A may be used by a qualified person as an exemption certificate.

Contractors purchasing property for use in the performance of a construction contract for a qualified person as described in subdivision (a)(5), who purchase qualified tangible personal property from an in-state retailer, or an out-of-state retailer obligated to collect use tax, must provide the retailer with a partial exemption certificate in order for the retailer to claim the partial exemption. If the retailer takes a timely partial exemption certificate in the proper form as set forth in subdivision (c)(3) and in good faith, from the contractor, the partial exemption certificate relieves the retailer from the liability for the sales tax subject to exemption under this regulation or the duty of collecting the use tax subject to exemption under this regulation.

The exemption certificate form set forth in Appendix B may be used by contractors as an exemption certificate when they are purchasing qualified tangible personal property for use in a construction contract for a qualified person.

(2) Blanket Partial Exemption Certificate. In lieu of requiring a partial exemption certificate for each transaction, a qualified person or contractor performing a construction contract for a qualified person may issue a general (blanket) partial exemption certificate. The partial exemption certificate forms set forth in Appendix A and Appendix B may be used as blanket partial exemption certificates. In the absence of evidence to the contrary, a retailer will be presumed to have taken a blanket partial exemption certificate in good faith if the certificate complies with the requirements set forth in this subdivision and otherwise appears valid on its face.

When purchasing tangible personal property not qualifying for the partial exemption from a seller to whom a blanket exemption certificate has been issued, the qualified person or contractor must clearly state in a contemporaneous document or documents such as a written purchase order, sales agreement, lease, or contract that the purchase is not subject to the blanket partial exemption certificate.

If contemporaneous physical documentation, such as a purchase order, sales agreement, lease, or contract is not presented for each transaction, any agreed upon designation which clearly indicates which items being purchased are or are not subject to the blanket partial exemption certificate, such as using a separate customer account number for purchases subject to the partial exemption, will be accepted, provided the means of designation is set forth on the blanket partial exemption certificate.

(3) Form of Partial Exemption Certificate. Any document, such as a letter or purchase order, timely provided by the purchaser to the seller will be regarded as a partial exemption certificate with respect to the sale or purchase of the tangible personal property described in the document if it contains all of the following essential elements:

(A) The signature of the purchaser, purchaser's employee, or authorized representative of the purchaser.

(B) The name, address and telephone number of the purchaser.

(C) The number of the seller's permit held by the purchaser or if the purchaser is not required to hold a seller's permit, a notation to that effect and the reason.

(D) A statement that the property purchased is:

1. To be used primarily for a qualifying activity as described in subdivision (a)(1)–(4), or

2. For use in the performance of a construction contract for a qualified person as described in subdivision (a)(5).

(E) A statement that the purchaser is:

1. a person primarily engaged in a qualifying line or qualifying lines of business, including the manufacturing lines of business described in NAICS Codes 3111 to 3399, electric power generation lines of business described in NAICS Codes 221111 to 221118, electric power distribution line of business described in NAICS Code 221122, and research and development lines of business described in NAICS Codes 541711 and 541712 (OMB 2012 edition), or

2. a contractor performing a construction contract for a qualified person primarily engaged in a qualifying line or qualifying lines of business, including the manufacturing lines of business described in NAICS Codes 3111 to 3399, electric power generation lines of business described in NAICS Codes 221111 to 221118, electric power distribution line of business described in NAICS Code 221122, and research and development lines of business described in NAICS Codes 541711 and 541712 (OMB 2012 edition).

(F) A statement that the property purchased is qualified tangible personal property as described in subdivision (b)(11)(A).

(G) A description of the property purchased.

(H) The date of execution of the document.

(4) Retention and Availability of Partial Exemption Certificates. A retailer must retain each partial exemption certificate received from a purchaser for a period of not less than four years from the date on which the retailer claims a partial exemption based on the partial exemption certificate.

(5) Good Faith. In the absence of evidence to the contrary, a seller will be presumed to have taken a partial exemption certificate in good faith if the certificate contains the essential elements as described in subdivision (c)(3) and otherwise appears to be valid on its face.

(d) When the Partial Exemption Does Not Apply. The exemption provided by this regulation shall not apply to either of the following:

(1) Any tangible personal property purchased by a qualified person during any calendar year that exceeds two hundred million dollars ($200,000,000) of purchases of qualified tangible personal property for which an exemption is claimed by the qualified person under this regulation. This limit includes qualified tangible personal property purchased for use by a contractor in the performance of a construction contract for the qualified person for which an exemption is claimed under this regulation.

For purposes of this subdivision, in the case of a qualified person that is required to be included in a combined report under RTC section 25101 or authorized to be included in a combined report under RTC section 25101.15, the aggregate of all purchases of qualified personal property for which an exemption is claimed pursuant to this regulation by all persons that are required or authorized to be included in a combined report shall not exceed two hundred million dollars ($200,000,000) in any calendar year.

For the purposes of this subdivision, "calendar year" includes the period July 1, 2014 to December 31, 2014, as well as the period January 1, 2030 to June 30, 2030. Accordingly, for calendar years 2014 and/or 2030, a qualified person may not exceed the $200,000,000 limit.

There is no proration of the $200,000,000 limit when the purchaser is a qualified person for only a portion of a calendar year. For example, if the qualified person began business on October 1, 2016, the qualified person may purchase up to $200,000,000 in qualified tangible personal property in the three months of 2016 they were in business.

(2) The sale or storage, use, or other consumption of property that, within one year from the date of purchase, is removed from California, converted from an exempt use under subdivision (a) to some other use not qualifying for exemption, or used in a manner not qualifying for exemption.

(e) Purchaser's Liability for the Payment of Sales Tax. If a purchaser certifies in writing to the seller that the tangible personal property purchased without payment of the tax will be used in a manner entitling the seller to regard the gross receipts from the sale as exempt from the sales tax, and the purchaser exceeds the two-hundred-million-dollar ($200,000,000) limitation described in subdivision (d)(1), or within one year from the date of purchase, the purchaser removes that property from California, converts that property for use in a manner not qualifying for the exemption, or uses that property in a manner not qualifying for the exemption, the purchaser shall be liable for payment of sales tax, with applicable interest, as if the purchaser were a retailer making a retail sale of the tangible personal property at the time the tangible personal property is so purchased, removed, converted, or used, and the cost of the tangible personal property to the purchaser shall be deemed the gross receipts from that retail sale.

(f) Leases. Leases of qualified tangible personal property classified as "continuing sales" and "continuing purchases" in accordance with Regulation 1660, Leases of Tangible Personal Property In General, may qualify for the partial exemption subject to all the limitations and conditions set forth in this regulation. The partial exemption established by this regulation may apply to rentals payable paid by a qualified person for a lease period beginning on or after July 1, 2014, with respect to a lease of qualified tangible personal property to the qualified person, which property is used primarily in an activity described in subdivision (a), notwithstanding the fact that the lease was entered into prior to the effective date of this regulation.

For purposes of this subdivision, in the case of any lease that is a continuing "sale" and "purchase" under subdivision (b)(1) of Regulation 1660, the one-year test period specified in subdivision (d)(2) of this regulation runs from the date of the first rental period which occurs on or after July 1, 2014, provided that the other conditions for qualifying for the partial exemption have been met. Any such rentals payable subject to the partial exemption shall continue to be taxed at the partial rate after expiration of the one-year period and lasting until such time as the lessee ceases to be a qualified person, converts the property for use in a manner not qualifying for the exemption, uses the property in a manner not qualifying for the partial exemption, or the partial exemption otherwise ceases to apply.

(g) Construction Contractors. The application of sales and use tax to construction contracts is explained in Regulation 1521, Construction Contractors. The terms "construction contract," "construction contractor," "materials," "fixtures," "time and material contract," and "lump sum contract" used in this regulation refer to the definitions of those terms in Regulation 1521. Nothing in this regulation is intended to alter the basic application of tax to construction contracts.

(1) Partial Exemption Certificates. As provided in subdivision (c)(1), construction contractors performing construction contracts for construction of special purpose buildings and foundations should obtain a partial exemption certificate from the qualified person (Appendix A). Contractors purchasing property from a retailer in this state or engaged in business in this state for use in the performance of a qualifying construction contract for a qualified person must timely furnish the retailer with a partial exemption certificate in order for the partial exemption to be allowed (Appendix B).

If a contractor accepts a certificate from a qualified person for the construction of a special purpose building or foundation and it is later determined that the building or foundation is not a qualifying structure as provided in subdivision (b)(11)(A)4., the qualifying person will be liable for the tax as provided in subdivision (e). If a contractor issues a certificate to its vendor to purchase tangible personal property for use in a construction contract for a qualified person subject to the partial exemption, and instead uses those materials for another purpose, the contractor will be liable for the tax as provided in subdivision (e).

(2) When a Construction Contractor is a Qualified Person. Equipment used by a construction contractor in the performance of a construction contract for a qualified person does not qualify for the partial exemption. For example, the lease of a crane used in the construction of a special purpose building does not qualify. However, a contractor that is also a qualified person as defined in subdivision (b)(10)(A) may purchase qualified tangible personal property subject to the partial sales and use tax exemption provided that all the requirements for the exemption are met. Like any other qualified person, a contractor making purchases qualifying for the exemption is subject to the $200,000,000 limit provided in subdivision (d)(1) with regard to the contractor's purchases for his or her own use.

(3) $200,000,000 Limit. As explained in subdivision (d)(1), the $200,000,000 limit on the partial exemption includes qualified tangible personal property purchased for use by a contractor in the performance of a construction contract for the qualified person for which an exemption is claimed under this regulation. In a time and material contract, the qualified person may consider the billed price of materials and fixtures to be the purchase price of these items for the purposes of the limit. In a lump-sum contract, the qualified person must obtain this information from job cost sheets or other cost information provided by the construction contractor.

(h) Claim for Refund. Qualified purchasers or contractors purchasing qualified tangible personal property for use in the performance of a construction contract for a qualified person who paid excess use tax to a seller or the Department may file a claim for refund with the Department. However, if the purchaser paid sales tax reimbursement, a timely claim for refund for sales tax must be filed by the retailer who reported the sale and the qualified purchaser must issue the seller a partial exemption certificate. In general, a claim for refund must be filed with the Department within the periods specified in RTC section 6902 to be timely.

History—Adopted July 17, 2014, effective September 25, 2014.

Amendments effective December 27, 2021. The amendments revised the title to insert a comma and delete "and" after "Manufacturing," and add ", and Electric Power"; revised subdivision (a) to add a comma and delete "and" after "Manufacturing," add ", and Electric Power Generation or Production, Storage, or Distribution," replace "2022" with "2030,", add "Revenue and Taxation Code (RTC)" before and delete "of the Revenue and Taxation Code (RTC)" after "section 6377.1," insert "RTC" before "sections," delete "of the RTC" after "6201.3" and " or 6201.15," and replace "S" with "s" in "Section" before "35" throughout the subdivision, and replace "A" with "a" in "article" in two places; added new subdivision (a)(4), renumbered subdivision (a)(4) as subdivision (a)(5), and replaced "the" with "a" after "contract for" and added "the generation … of electric power,"; added new subdivisions (b)(1), (3), (15), and (16) and renumbered old subdivisions (b)(1), (2) through (12), and (13), as subdivisions (b)(2), (4) through (14), and (17); deleted "to be" after "considered" in subdivision (b)(5); replaced "(b)(3)" with "(b)(5)" throughout subdivision (b)(8); added "a qualifying line … in this subdivision" after "engaged in" in subdivision (b)(10)(A), reformatted the text after "engaged in" as subdivisions (b)(10)(A)1, and renumbered subdivisions (b)(10)(A)1 through 3 as (b)(10)(A)2 through 4; revised subdivision (b)(10)(A)1 to add "Prior to… are" and the second paragraph, reformat the remaining text as the third paragraph, replace "six digit" with "six-digit" and "four digit" with "four-digit" throughout, and delete "For the purposes of this subdivision:" from the end; replaced "A" with "For purposes of this subdivision, a" in subdivision (b)(10)(A)2; revised the second paragraph of subdivision (b)(10)(A)2 to replace "derives" with "derived," "expends" with "expended," "line of business described in Codes 3111 to 3399, inclusive, 541711 or 541712 of the NAICS" with "qualifying line of business," "constitutes" with "constituted," "the" with "its" before "total," "For purposes of" with "Revenue from," and ", revenues could be derived from, but are" with "includes, but is," delete "for the legal entity" after "total revenue," and add "its" before "gross" and "operating" and "revenue derived from" before "selling"; revised the third paragraph of subdivision (b)(10)(A)2 to replace "derives" with "derived" in two places, "expends" with "expended," "allocates" with "allocated," and "assigns" with "assigned," and add "its" before "gross" and "operating,"; revised the fourth paragraph of subdivision (b)(10)(A)2 to replace "this test" with "these tests," "manufacturing" with "activities in qualifying," "derives" with "derived" after "a company," "%" with "percent" throughout, "are" with "was," "contracts" with "activities" after "development," "the" with "its" after "60 percent of," "are" with "was derived" before "from activities," delete "the" before "gross revenue may," "s" from the end of "revenues" throughout, "and from qualified research and development lines of business" from the end of the first sentence, and "qualifying" before and add "in qualifying lines of business" after "activities" at the end; added "s" after "test" and deleted "manufacturing or research and development" before "lines" in the fifth paragraph, added "or qualifying lines" to the seventh paragraph, and inserted "a" before "qualifying" and replaced "manufacturing or research and development activities" with "line of business" in the eighth paragraph of subdivision (b)(10)(A)2; added a comma after "of locations" and the second "thereof" in and deleted the parentheses before and after "including any portion or portions thereof" throughout subdivision (b)(10)(A)3; revised subdivision (b)(10)(A)4 to add "or generating or producing, storing, or distributing electric power" in two places, add a new third sentence, replace "those" with "a qualifying line or qualifying," and delete "described in Codes 3111 and 3339, inclusive, 541711, or 541712" after "of business"; replaced "(b)(8)(A)" with "(b)(10)(A) in subdivision (b)(10)(B); replaced "An" with "Prior to January 1, 2018, an" in subdivision (b)(10)(B)1; deleted the "2." to make subdivision (b)(10)(B)2 part of subdivision (b)(10)(B)1 and combined the first two sentences in reformatted subdivision (b)(10)(B)1 by replacing the period after "25128" with "or" and "A" with "a"; add a new subdivision (b)(10)(B)2; deleted "all of" before "the following" in subdivision (b)(11)(A); replaced "meet the" with "have a" and "requirement of subdivision (b)(13)" with "of one or more years" in subdivision (b)(11)(A)1; added a new second sentence to subdivision (b)(11)(A)4; replaced "a" with "that" in and deleted "which is not a qualifying purpose" from the end of subdivision (b)(11)(A)4c; deleted the comma before and the semi-colon after "or commercial building" in subdivision (b)(11)(A)4e; deleted the comma and inserted "and" after "mining" in subdivision (b)(11)(B)2; added a new sentence to the end of subdivision (b)(17); replaced "who" with "that" and deleted "as defined in subdivision (c)(4)" after "faith" in the first paragraph of subdivision (c)(1); revised the second paragraph of subdivision (c)(1) to add a comma after "occasion" "a" before "purchase," and "purchaser’s," replace "potential qualified person" with "purchaser," after "a," "The" with "In such circumstances, the," and "as if the purchaser were a retailer making a retail sale of the tangible personal property at the time the tangible personal property is purchased" with ", and the cost … sale," and delete "until the expiration of the one year period following the date of purchase as provided in subdivision (b)(8)(A)" from the end of the first sentence; revised the third paragraph of subdivision (c)(1) to replace "pays" with "reimbursed the retailer for," insert "sales" before "tax at" and "for the excess … the purchaser," and delete "from a qualified person" before and "or if the retailer receives a certificate from a contractor purchasing qualified tangible personal property for use in the performance of a construction contract for a qualified person," after "under these circumstances,"; added "by a qualified person" to the fourth paragraph of subdivision (c)(1); replaced "(a)(4)" with "(a)(5)" and deleted "as defined in subdivision (c)(5)" after "faith" in the fifth paragraph and deleted "construction" before "contractors" in the sixth paragraph of subdivision (c)(1); revised subdivision (c)(2) to add "or contractor … for a qualified person," "general," parentheses around "blanket," "the" before "absence," "otherwise appears valid on its face" after "subdivision," "blanket" before "partial exemption certificate, such," and "partial" after "on the blanket," replace "may accept an otherwise valid" with "will be presumed to have taken a," and delete "sale or" before "purchase is"; added "or … reason" to and deleted the last sentence from subdivision (c)(3)(C), which provided, "If the purchaser is not required to hold a permit because the purchaser sells only property of a kind the retail sale of which is not taxable, e.g., food products for human consumption, or because the purchaser makes no sale in this state, the purchaser must include on the certificate a sufficient explanation as to the reason the purchaser is not required to hold a California seller’s permit in lieu of a seller’s permit number"; replaced "(3)" with "(4)" in subdivision (c)(3)(D)1; revised subdivision (c)(3)(D)2 to delete "by a contractor purchasing that property for use" after "For use," and replace "the" with "a" before "qualified," and "(a)(4)" with "(a)(5)"; added "qualifying line … including the" and "lines of" after "manufacturing," and replaced "or in" with ", electric power generation … 221122, and" and "activities as" with "lines of business" after "development" in subdivision (c)(3)(E)1; added "a qualifying line … including the" and "lines of" after "manufacturing," and replaced "or in a" with ", electric power generation … 221122, and" and "activities as" with "lines of business" after "development" in subdivision (c)(3)(E)2; replaced "(7)(A)" with "(b)(11)(A)" in subdivision (c)(3)(F); inserted "the" in subdivision (c)(3)(G); replaced "qualified person" with "purchaser" in subdivision (c)(4); revised subdivision (c)(5) to replace "A" with "In the absence of evidence to the contrary, a" and "in the absence of evidence to the contrary" with "if … face" and delete the last sentence, which provided, "A seller, without knowledge to the contrary, may accept a partial exemption certificate in good faith where a qualified person or a contractor performing a construction contract for a qualified person provides a certificate meeting the requirements provided in subdivision (c)(3)"; revised subdivision (d)(1) to replace "fixtures and materials sold or used in the construction of special purpose buildings and foundations" with "qualified tangible personal property purchased … regulation," "2022" with "2030" throughout, and insert "the" before and replace "in purchases of qualified tangible personal property for which an exemption is claimed by the qualified person under this regulation" with "limit" after "$200,000,000" in the third paragraph; replaced "(b)(9)(A)4" with "(b)(11)(A)4"in subdivision (g)(1); revised subdivision (g)(2) to replace "Construction Contractors as Qualified Persons" with "When a Construction Contractor is a Qualified Person," and "(b)(8)" with "(b)(10)(A)," add "qualified tangible personal," "that" before and "the" after "all," "the" before "exemption are," and "subdivision" before "(d)(1)"; replace "for" with "on" and "fixtures and materials sold or used in the construction of special purpose buildings and foundations" with "qualified tangible … regulation" in subdivision (g)(3); revised subdivision (h) to delete the commas after "purchasers" and "person," "or tax reimbursement" after "excess use tax," and "if the purchase was a use tax transaction" from the end of the first sentence, replace "the" with "a" before "seller," "Board" with "Department" throughout, "purchase was a" with "purchaser paid," "transaction" with "reimbursement," "order to be timely, the" with "general, a," and "of the RTC" with "to be timely," and add "excess use," "timely" before "claim," "s" after "period," and "RTC"; added references to Government Code sections 15570.22 and 15570.24 to the authority note; revised Appendix A and B to delete "AND" before and add ", AND ELECTRIC POWER" after "RESEARCH & DEVELOPMENT," replace "2022" with "2030" throughout, insert "personal" before "property purchased," delete "specific" after "If this is a," add "for a specific purchase" and "a qualifying line … including," delete "processing, refining, fabricating, or recycling" before "as described in Codes 3111," add ", electric power generation … 221122 of the NAICS," and replace "(b)(9)" with "(b)(11)" in footnote; revised Appendix A to replace "to" with "for" after "applies," delete "or" after "above;," add a new fourth item to the list of qualified uses and reformat the former fourth item as the fifth item, add a comma and delete "; or I am primarily engaged in biotechnology, or physical, engineering, and life sciences " after "(NAICS)²," add "or" to the end of the first bulleted item, add a new second bulleted item and reformat the following bulleted items as sub-bulleted items, delete "within one year of the date of purchase or lease" after "California," and add "the property is" to the beginning of the second and third sub-bulleted items; revised Appendix B to add "the generation … of electric power," add "a contractor," add a comma and delete "or primarily engaged in biotechnology, or physical, engineering, and life sciences" after "(NAICS)²," and add a comma after "and development."

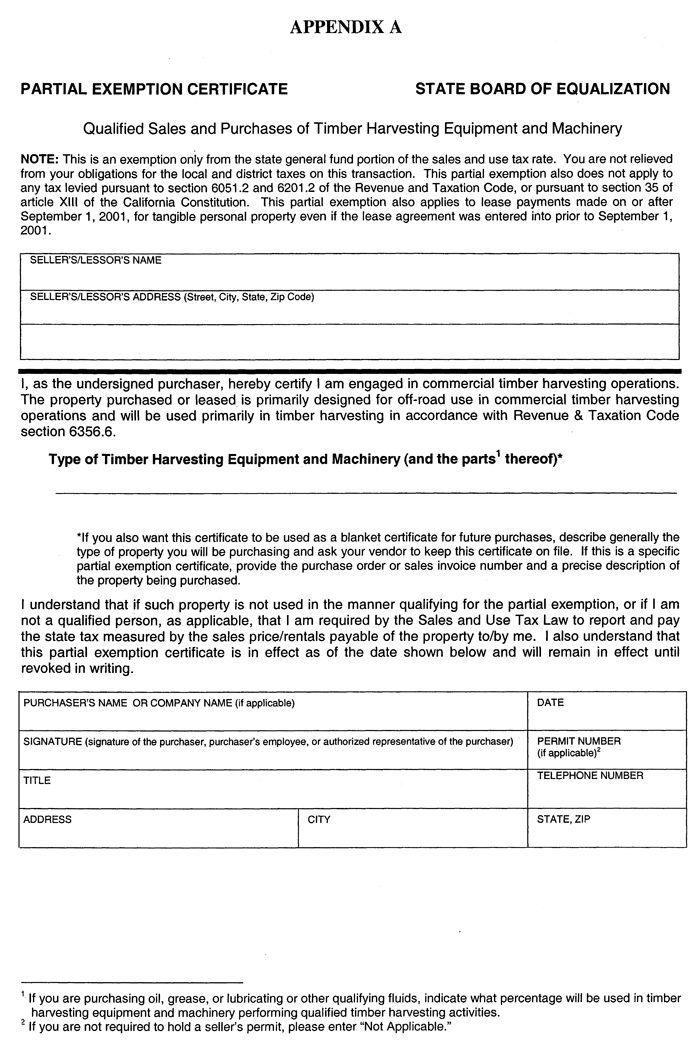

Appendix A

Partial Exemption Certificate for Manufacturing, Research and Development, and Electric Power Equipment – Section 6377.1

This is a partial exemption from sales and use taxes at the rate of 4.1875% from July 1, 2014 to December 31, 2016, and at the rate of 3.9375% from January 1, 2017 to June 30, 2030. You are not relieved from your obligations for the remaining state tax and local and district taxes on this transaction. This partial exemption also applies for lease periods occurring on or after July 1, 2014 and before July 1, 2030, for leases of qualified tangible personal property even if the lease agreement was entered into prior to July 1, 2014.

I hereby certify that the tangible personal property described below and purchased or leased from:

SELLER'S/LESSOR'S NAME

SELLER'S/LESSOR'S ADDRESS (Street, City, State, Zip Code)

is qualified tangible personal property and will be used by me primarily (please check one):

□ 1. for manufacturing, processing, refining, fabricating, or recycling;

□ 2. for research and development;

□ 3. to maintain, repair, measure, or test any property being used for (1) or (2) above; or

□ 4. for the generation or production, storage, or distribution of electric power;

□ 5. as a special purpose building and/or foundation.

Description of qualified tangible personal property purchased or leased1:

If this is a partial exemption certificate for a specific purchase, provide the purchase order or sales invoice number and a precise description of the property being purchased. If you want this certificate to be used as a blanket certificate for future purchases, describe generally the type of property you will be purchasing and ask your vendor to keep this certificate on file.

I, as the undersigned purchaser, hereby certify I am primarily engaged in a qualifying line or qualifying lines of business, including manufacturing, as described in Codes 3111 to 3399 of the North American Industry Classification System (NAICS)2, research and development, as described in Codes 541711 and 541712 of the NAICS, electric power generation, as described in Codes 221111 to 221118 of the NAICS, and electric power distribution, as described in Code 221122 of the NAICS.

I understand that by law, I am required to report and pay the state tax (calculated on the sales price/rentals payable of the property) at the time the tangible personal property is so purchased, removed, converted, or used if:

- the purchase exceeds the $200 million limitation; or

- within one year of the date of purchase or lease:

- the property is removed from California;

- the property is converted for use in a manner not qualifying for the exemption; or

- the property is used in a manner not qualifying for the partial exemption.

Name of Purchaser

Signature of Purchaser, Purchaser's Employee, or Authorized Representative

Printed Name of Person Signing Title

Address of Purchaser

Permit Number (if You Are Not Required to Hold a Permit, Explain Why)

Telephone Number

Email Address of Person Signing Date

1See Regulation 1525.4, subdivision (b)(11) for a description of what is included and excluded from "qualified tangible personal property."

2Published by the US Office of Management and Budget, 2012 edition.

Appendix B

Construction Contracts - Partial Exemption Certificate For Manufacturing, Research and Development, and Electric Power Equipment – Section 6377.1

This is a partial exemption from sales and use taxes at the rate of 4.1875% from July 1, 2014 to December 31, 2016, and at the rate of 3.9375% from January 1, 2017 to June 30, 2030. You are not relieved from your obligations for the remaining state tax and local and district taxes on this transaction.

I hereby certify that the tangible personal property described below and purchased from:

Printed Name of Person Signing Title

Seller's/Lessor's Name

Printed Name of Person Signing Title

Seller's/Lessor's Address (Street, City, State, Zip Code)

is qualified tangible personal property and will be used by me in the performance of a construction contract for a qualified person who will use that property as an integral part of the manufacturing, processing, refining, fabricating, or recycling process, the generation or production, storage, or distribution of electric power, or as a research or storage facility for use in connection with those processes.

Description of qualified tangible personal property purchased1:

If this is a specific partial exemption certificate, provide the purchase order or sales invoice number and a precise description of the property being purchased. If you want this certificate to be used as a blanket certificate for future purchases, describe generally the type of property you will be purchasing and ask your vendor to keep this certificate on file.

I further certify I am a contractor performing a construction contract for a qualified person primarily engaged in a qualifying line or qualifying lines of business, including manufacturing, as described in Codes 3111 to 3399 of the North American Industry Classification System (NAICS)2, research and development, as described in Codes 541711 and 541712 of the NAICS, electric power generation, as described in Codes 221111 to 221118 of the NAICS, and electric power distribution, as described in Code 221122 of the NAICS.

I understand that if I use the property for any purpose other than indicated above, I am required to report and pay the state tax measured by the sales price of the property to me.

Name of Purchaser

Signature of Purchaser, Purchaser's Employee, or Authorized Representative

Printed Name of Person Signing

Title

Address of Purchaser

Permit Number (if You Are Not Required to Hold a Permit, Explain Why)

Telephone Number

Email Address of Person Signing

Date

1See Regulation 1525.4, subdivision (b)(11) for a description of what is included and excluded from "qualified tangible personal property."

2Published by the US Office of Management and Budget, 2012 edition.

Regulation 1525.5. Manufacturing By-Products and Joint-Products.

Reference: Sections 6094 and 6244, Revenue and Taxation Code.

(a) In General. Manufacturers and refiners are consumers of tangible personal property purchased for the purpose of use and consumed in the manufacturing or refining process, including that portion of purchased raw materials that comprise by-products that are produced and consumed during the manufacturing or refining process, or subsequent thereto.

(b) Definitions.

(1) Property Purchased. As used herein the term "property purchased" means materials that have been acquired in a transaction defined as a "purchase" pursuant to Section 6010 of the Revenue and Taxation Code and includes property acquired by purchase from a joint venture of which the manufacturer or refiner is a member.

(2) Split-Off Point. The point at which joint products being manufactured or refined become separately identifiable.

(3) Separable Costs. All costs incurred to further process and dispose of products and by-products after split-off point.

(4) By-Products. As used herein the term "by-products" means products simultaneously produced from the manufacturing process, including joint-products.

(5) Net Realizable Value. The market value or sales value of a product or by-product less costs of completion and disposal after split-off point, if any.

(c) Commingled Goods. When a manufacturer or refiner purchases property for resale, and prior to or during the refining or manufacturing process, physically commingles these materials with property not so purchased of such similarity that the identity of the materials that comprise this commingled mass cannot be determined, by-products that are produced from the mass of commingled goods and consumed shall be deemed to be first consumed from the property not purchased for resale until a quantity of commingled goods equal to the quantity of property not purchased for resale has been consumed.